Europe is embarking on a transition towards climate neutrality and digital leadership. The European industrial strategy aims to ensure that European industry can lead the way as we enter this new age.

On 10 March 2020, the Commission laid the foundations for an industrial strategy that would support the twin transition to a green and digital economy, make EU industry more competitive globally, and enhance Europe’s open strategic autonomy. The day after the new industrial strategy was presented, the World Health Organization announced the COVID-19 as a pandemic.

On 11 May 2021, the Commission updated the EU Industrial Strategy to ensure that its industrial ambition takes full account of the new circumstances following the COVID-19 crisis and helps to drive the transformation to a more sustainable, digital, resilient and globally competitive economy. This update neither replaces the 2020 Industrial Strategy nor completes the processes launched by it – much of that work is in progress, and requires dedicated efforts. This is a targeted update, which focuses on what more needs to be done and what lessons need to be learned.

As a primary vehicle of innovation in the various ecosystems, small and medium enterprises (SMEs) need to be kept in mind in all actions under this Strategy. This is reflected in a horizontal manner by increased attention to regulatory burdens for SMEs. New actions will strongly benefit SMEs and start-ups, whether it be from a strengthened Single Market, reduced supply dependencies or the accelerated green and digital transitions. The Strategy also includes some measures dedicated to SMEs such as on increased resilience, combating late payments, and supporting solvency.

Lessons learned from the COVID-19 crisis

The COVID-19 crisis has strongly affected the EU economy. Its impact varies across ecosystems and companies’ size. The crisis exposed the interdependence of global value chains and demonstrated the critical role of a globally integrated and well-functioning Single Market.

While the impact of the crisis varies across different ecosystems and companies, the key issues highlighted by the crisis are:

- Borders restricting free movement of people, goods and services

- Interrupted global supply chains affecting availability of essential products

- Disruption of demand

To address these issues, the updated Industrial Strategy is proposing new measures to take into account the lessons learned from the crisis and sustain investment. In particular, it focuses on:

Strengthening of the resilience of the Single Market

Supporting Europe’s Open Strategic Autonomy through dealing with dependencies

Supporting the business case for the twin transitions

Resilience of the Single Market

The Single Market is the EU’s most important asset, offering certainty, scale and a global springboard for European companies. However, the COVID-19 pandemic has affected the opportunities offered by the Single Market. Businesses and citizens suffered from border closures, supply was disrupted and predictability was often lacking.

To address these issues, the Commission has proposed:

Single Market Emergency Instrument: to provide a structural solution to ensure the availability and free movement of persons, goods and services in the context of possible future crises

Deepening the Single Market: explore harmonisation of standards for key business services; as well as strengthening the digitalisation of market surveillance and other targeted measures for SMEs

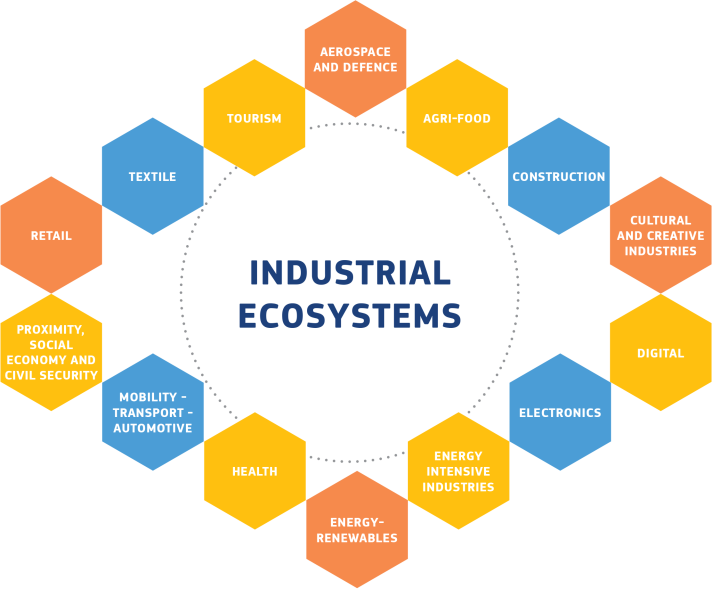

Monitoring the Single Market: an annual analysis of the state of the Single Market, including across 14 industrial ecosystems

14 industrial ecosystems are: aerospace and defence, agri-food, construction, cultural and creative industries, digital, electronics, energy intensive industries, energy-renewables, health, mobility – transport – automotive, proximity, social economy and civil security, retail, textile and tourism

For the EU, a major importer and exporter, openness to trade and investment is a strength and source of growth and resilience. But COVID-19 has shown disruptions in global supply chain and led to shortages of certain critical products in Europe. This is why we need to further improve our open strategic autonomy in key areas, as already set out in the EU’s 2020 Industrial Strategy.

The Commission is proposing:

Diversified international partnerships: to ensure that trade and investment continue to play a key role in building our economic resilience.

Industrial Alliances can also be an appropriate tool, if they accelerate activities that would not develop otherwise, and where they help to attract private investors to discuss new business partnerships and models in a manner that is open, transparent and fully compliant with competition rules, and where they have a potential for high value job creation. Alliances provide a platform that is broad and open in principle, and will pay particular attention to inclusiveness for start-ups and SMEs. The Commission is preparing the launch of the Alliance on processors and semiconductor technologies and the Alliance for Industrial Data, Edge and Cloud and considering the preparation of an Alliance on Space Launchers and an Alliance on Zero Emission Aviation.

Monitoring of Strategic dependencies: publishing a first report analysing the EU’s strategic dependencies. The report identifies 137 products in sensitive ecosystems for which the EU is highly dependent on foreign sources.

Strategic dependencies analysis

- 137 products in sensitive ecosystems for which the EU is highly dependent on foreign suppliers, from a total of 5200 products analysed

- These products represent 6% of the value of all imported products in Europe.

- Over half of these dependencies originate in China, followed by Vietnam and Brazil.

- 34 products are more vulnerable, with low potential for diversification and substitution with EU production. They include various raw materials and chemicals used in energy-intensive industries and health.

- These products represent 0.6% of the value of all imported products in Europe.

The report also offers an in-depth analysis of 6 strategic areas where the EU has dependencies: raw materials batteries active pharmaceutical ingredients hydrogen semiconductors cloud and edge technologies:

- raw materials

- batteries

- active pharmaceutical ingredients

- hydrogen

- semiconductors

- cloud and edge technologies

Accelerating twin transitions

The 2020 Industrial Strategy included a list of actions to support the green and digital transitions of EU industry, many of which have already been adopted or launched. The pandemic has however drastically affected the speed and scale of this transformation. Companies pursuing sustainability and digitalisation are more likely to be among tomorrow’s leaders.

To accelerate the twin transitions, the Commission has proposed:

Transition pathways

Transition pathwaysCo-create jointly with industry and stakeholders, transition pathways to identify the actions needed to achieve the twin transitions, giving a better understanding of the scale, benefits and conditions required.

Multi-country projects

Multi-country projectsTo support the recovery efforts and develop digital and green capacities, the Commission will support Member States in joint projects to maximise investments under the Recovery and Resilience Facility.

Analysis of the steel sector

Analysis of the steel sectorTo ensure a clean and competitive steel industry, the Commission analyses and addresses challenges for this sector.

Horizon Europe partnerships

Horizon Europe partnershipsBringing together private and public funding to finance research and innovation on low-carbon technology and processes.

Abundant, accessible and affordable decarbonised energy

Abundant, accessible and affordable decarbonised energyThe Commission will work with Member States to accelerate investments into renewables, grids and address barriers.

Documents

- 5 MAY 2021

- 5 MAY 2021

- 5 MAY 2021

- 5 MAY 2021

- 10 MARCH 2020

- Downloadбългарски(255.67 KB - HTML)

- Downloadespañol(209.98 KB - HTML)

- Downloadčeština(206.48 KB - HTML)

- Downloaddansk(205.63 KB - HTML)

- DownloadDeutsch(211.98 KB - HTML)

- Downloadeesti(201.78 KB - HTML)

- Downloadελληνικά(264.16 KB - HTML)

- Downloadfrançais(215.71 KB - HTML)

- Downloadhrvatski(202.92 KB - HTML)

- Downloaditaliano(209.29 KB - HTML)

- Downloadlatviešu(206.47 KB - HTML)

- Downloadlietuvių(206.23 KB - HTML)

- Downloadmagyar(213.67 KB - HTML)

- DownloadMalti(209.03 KB - HTML)

- DownloadNederlands(208.81 KB - HTML)

- Downloadpolski(210.82 KB - HTML)

- Downloadportuguês(209.5 KB - HTML)

- Downloadromână(214.04 KB - HTML)

- Downloadslovenčina(206.48 KB - HTML)

- Downloadslovenščina(201.53 KB - HTML)

- Downloadsuomi(206.04 KB - HTML)

- Downloadsvenska(202.57 KB - HTML)

- 10 MARCH 2020

- Downloadбългарски(277.02 KB - HTML)

- Downloadespañol(228.23 KB - HTML)

- Downloadčeština(231.48 KB - HTML)

- Downloaddansk(222.35 KB - HTML)

- DownloadDeutsch(232.5 KB - HTML)

- Downloadeesti(218.59 KB - HTML)

- Downloadελληνικά(288.22 KB - HTML)

- Downloadfrançais(235.21 KB - HTML)

- Downloadhrvatski(221.4 KB - HTML)

- Downloaditaliano(228.4 KB - HTML)

- Downloadlatviešu(221.3 KB - HTML)

- Downloadlietuvių(221.49 KB - HTML)

- Downloadmagyar(230.93 KB - HTML)

- DownloadMalti(226.27 KB - HTML)

- DownloadNederlands(225.07 KB - HTML)

- Downloadpolski(226.91 KB - HTML)

- Downloadportuguês(226.01 KB - HTML)

- Downloadromână(230.66 KB - HTML)

- Downloadslovenčina(228.68 KB - HTML)

- Downloadslovenščina(217.55 KB - HTML)

- Downloadsuomi(225.11 KB - HTML)

- Downloadsvenska(225.28 KB - HTML)

- 10 MARCH 2020

- 10 MARCH 2020

- Downloadбългарски(1.04 MB - HTML)

- Downloadespañol(211.75 KB - HTML)

- Downloadčeština(206.81 KB - HTML)

- Downloaddansk(1.04 MB - HTML)

- DownloadDeutsch(1.04 MB - HTML)

- Downloadeesti(201.62 KB - HTML)

- Downloadελληνικά(1.04 MB - HTML)

- Downloadfrançais(214.68 KB - HTML)

- Downloadhrvatski(1.04 MB - HTML)

- Downloaditaliano(209.33 KB - HTML)

- Downloadlatviešu(1.04 MB - HTML)

- Downloadlietuvių(205.4 KB - HTML)

- Downloadmagyar(1.04 MB - HTML)

- DownloadMalti(212.36 KB - HTML)

- DownloadNederlands(1.04 MB - HTML)

- Downloadpolski(209.46 KB - HTML)

- Downloadportuguês(1.04 MB - HTML)

- Downloadromână(211.9 KB - HTML)

- Downloadslovenčina(1.04 MB - HTML)

- Downloadslovenščina(1.04 MB - HTML)

- Downloadsuomi(208.78 KB - HTML)

- Downloadsvenska(1.04 MB - HTML)

- 10 MARCH 2020