We asked EU budget opinion leaders what the revenue to the EU budget should look like. Watch the videos to see what they said, and keep reading to learn more about our most recent proposal.

Views expressed in the videos are personal views of the speakers based on their professional background. They do not represent the views of the organisation they represent.

The need to introduce new own resources of the EU budget has been on the EU agenda for a long time. Some of the key arguments in favour of new sources of revenue have been:

- introducing more diversified and resilient types of own resources, directly related to EU competences, objectives and priorities

- reforming the own resources system to support EU priorities, by designing new own resources that bring also additional benefits alongside new income streams

- bringing more proportionality, fairness and stabilising impact to the EU budget, while reflecting the fluctuations in Member States' economic cycles

- reducing the weight of the Gross National Income (GNI)-based own resource in the EU budget

New sources of revenue for the EU budget

In the coming years the Commission, the European Parliament and EU countries in the Council will continue working together to introduce new own resources for the EU budget. The Commission proposes to embed EU policy priorities further in the revenue side of the EU budget, supporting the twin green and digital transitions.

These resources will not create new taxes for Europeans, as the EU does not have the power to levy taxes. Tax instruments are mainly deployed at national level: the introduction of new categories of own resources will fully respect national fiscal sovereignty.

On 22 December 2021, the Commission proposed three new sources of revenue for the EU budget. On 20 June 2023, the Commission completed its proposal for a next generation of own resources.

|

| Emissions Trading System own resource: a share of revenues from the EU-wide system which aims to help reduce net greenhouse gas emissions in the EU by at least 55% by 2030, compared to 1990, to reach climate neutrality by 2050. The proposed new own resource would direct 30% of the revenues from emissions trading in the EU to the EU budget. |

|

|

Carbon border adjustment mechanism (CBAM) own resource: a share of revenues from the mechanism, which applies to any product imported from a country outside of the EU that does not have a system to price carbon, like the EU ETS (see above). This is meant to adjust the price of the imported goods as if they were produced in the EU and ensure fairness for European companies. The new own resource proposes that 75% of what EU countries collect under CBAM should go to the EU budget. |

|

|

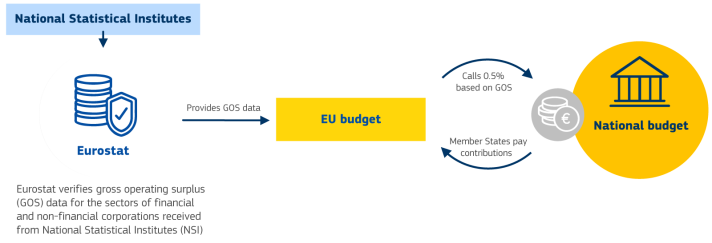

A temporary statistical based own resource on company profits: The new statistical own resource based on company profits will be temporary, to be replaced by a possible contribution from Business in Europe: Framework for Income Taxation (BEFIT), once proposed and unanimously agreed by all Member States. The own resource will be calculated as 0.5% of the notional EU company profit base, an indicator calculated by Eurostat on the basis of the national accounts statistics. |

New own resources for NextGenerationEU and the European Green Deal

The proposed new sources of revenue will help repay the grants part of the NextGenerationEU recovery instrument that the European Commission, on behalf of the EU, is financing via capital markets funding. The new own resources should also finance the Social Climate Fund, designed to make sure the transition to a decarbonised economy leaves no one behind.

Once adopted, these revenues will provide the Union the means for its ambitions – a climate-neutral, digital, just, inclusive and resilient society for all Europeans.

Next steps

The Commission will now continue working with the European Parliament and with the EU Member States in the Council towards a swift adoption of the proposed new sources of revenue.

Press material

20 June 2023

22 December 2021

Legal texts

- General publications

The legal texts for the own resources package adopted by the Commission on 22 December 2021 and 20 June 2023.