(*) Key achievements in the table state which period they relate to. Many come from the implementation of the predecessor programmes under the 2014-2020 multiannual financial framework. This is expected and is due to the multiannual life cycle of EU programmes and the projects they finance, where results often follow only after completion of the programmes.

Budget for 2021-2027

(million EUR)

Financial programming (*) | 3 378.4 |

NextGenerationEU | 6 074.1 |

Decommitments made available again (**) | N/A |

Contributions from other countries and entities (***) | 36.7 |

Total budget 2021-2027 | 9 489.2 |

Complementary budget (****) | 2 682.0 |

Common provisioning fund – blending operations | 1 391.0 |

Common provisioning fund – Member State compartments | 1 226.0 |

Advisory Hub – top-up from other programmes | 65.0 |

(*) Amounts stemming from the Cohesion contributions for the Member State compartment and reflows from predecessor legacy instruments included.

(**) Only Article 15(3) of the financial regulation.

(***) Amount stemming from EFTA and Member State contributions for the 2021-2022 period.

(****) The following amounts are not included in the total budget of InvestEU above. They represent amounts delegated from other programmes for blending operations for 2021-2027 and Member States compartments from signed agreements for the 2023-2027 period.

Rationale and design of the programme

The InvestEU programme aims to ensure an additional boost to investments fostering recovery, resilience, green growth and employment in the EU over the 2021-2027 period. This goal is achieved by mobilising public and private financing sources, in order to provide long-term funding and support to companies and projects in line with the EU priorities in the current challenging economic and social context.

Furthermore, InvestEU will be an important vehicle to implement the REPowerEU Plan as well as the Green Deal Industrial Plan, aiming to accelerate clean tech and industrial innovation to reach the EU’s 2030 clean energy targets.

The unprecedented domestic and global challenges that the world is currently facing have a significant impact on the EU economy. In order to pave the way to sustained and inclusive growth – while raising our global competitiveness, enhancing socioeconomic convergence and the cohesion of the EU, and advancing the digital and green transitions – the EU needs increased investment, including in innovation, digitisation, the efficient use of resources and upgrading of skills and infrastructure. This, in turn, requires expanding the supply and diversifying the sources of external funding for EU businesses.

The EU intervention can add value by addressing market failures or sub-optimal investment situations (e.g. when, because of its public good nature, the full benefits of given investments cannot be captured by private agents, or the investment produces additional advantages beyond those flowing to the investing company or operator). The EU intervention can also help to reduce the investment gap in targeted sectors (e.g. in investments with a significant cross-border dimension or in sectors, countries, or regions where risk exceeds levels that private financial actors are able or willing to accept). Finally, an EU-level intervention can ensure that a critical mass of resources can be leveraged to maximise the impact of investment on the ground.

By supporting projects that provide EU added value, InvestEU is complementary to Member State investments. In addition, InvestEU provides for economies of scale in the use of innovative financial products by catalysing private investment across the EU.

The mission of InvestEU is to support the EU’s policy objectives through financing and investment operations that contribute to:

- competitiveness, including research, innovation and digitisation;

- employment and growth, its sustainability and its environmental and climate dimension contributing to the achievement of the United Nations sustainable development goals, the objectives of the Paris climate agreement and the creation of high-quality jobs;

- social resilience, inclusiveness and innovation;

- the promotion of scientific and technological advances in culture, education and training;

- the integration of the EU’s capital markets and the strengthening of the single market, including solutions addressing capital market fragmentation, diversifying sources of financing for EU enterprises and promoting sustainable finance;

- the promotion of economic, social and territorial cohesion;

- a sustainable and inclusive recovery after the crisis caused by the COVID-19 pandemic, upholding and strengthening the EU’s strategic value chains and maintaining and reinforcing activities of strategic importance to the EU;

- achieving the EU policy objectives in areas included in the REPowerEU and Green Deal industrial plan.

InvestEU has the following specific objectives:

- supporting financing and investment operations related to sustainable infrastructure;

- supporting financing and investment operations related to research, innovation and digitisation;

- increasing access to and the availability of finance for small and medium-sized enterprises (SMEs) and for small mid-cap companies and enhancing their global competitiveness;

- increasing access to and the availability of microfinance and finance for social enterprises, to support financing and investment operations related to social investment, competences and skills, and to develop and consolidate social investment markets.

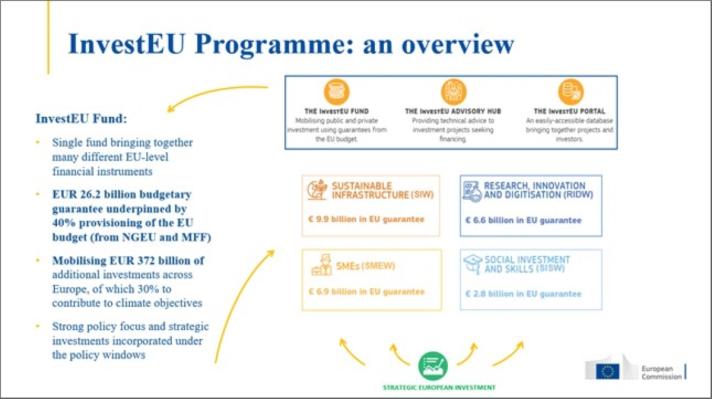

The InvestEU Fund provides EU guarantees to support eligible financing and investment operations carried out by the implementing partners. In addition, through the InvestEU Advisory Hub, InvestEU provides advisory support for the development of viable projects, access to financing and related capacity-building assistance. Moreover, the InvestEU Portal increases the visibility of investment projects to a large network of investors worldwide.

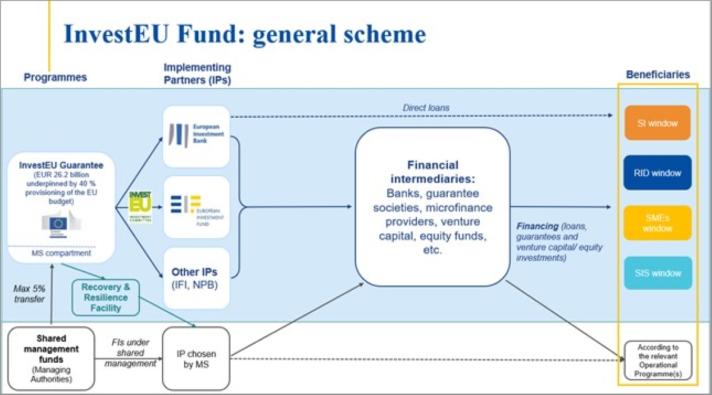

InvestEU is implemented in indirect management through the European Investment Bank (EIB) Group and other implementing and advisory partners. DG Economic and Financial Affairs is in the lead for the Commission. The programme is bringing together under one roof the multitude of EU financial instruments, budgetary guarantees and advisory services available to support investment in the EU. By providing a budgetary guarantee, InvestEU aims to make EU funding for investment projects in Europe simpler, more efficient and more flexible.

The InvestEU programme consists of:

- the InvestEU Fund, the successor of the European Fund for Strategic Investments (EFSI) and other 13 centrally-managed financial instruments. It operates through four policy windows that address market failures or sub-optimal investment situations within their specific scope;

- the InvestEU Advisory Hub, the successor of the European Investment Advisory Hub (EIAH) and other 12 centrally-managed advisory programmes/initiatives; and

- the InvestEU Portal, the successor of the European Investment Project Portal (EIPP).

The InvestEU programme, including the InvestEU Fund, is a demand-driven instrument, responding to the investment and finance needs of public and private market participants. Finance supported by the InvestEU Fund should support financing and investment operations with a higher risk profile that require risk-sharing through the EU budget, in order to unlock additional private and public finance. The programme aims at contributing to the necessary conditions for the competitiveness of the EU economy and industry (in accordance with Article 173 of the Treaty on the Functioning of the European Union). This is done by providing financial products designed to address EU-wide and Member State specific market failures and suboptimal investment situations, which cannot be sufficiently achieved by the Member States, but can rather be better realised at EU level.

In the context of the InvestEU programme, the Commission may implement blending operations (referred to in Article 6 of the InvestEU regulation) supported by different EU programmes and funds.

In accordance with Article 10 of the InvestEU regulation, Member States can also contribute on a voluntary basis to the InvestEU Member State compartment with Recovery and Resilience Facility funds, structural and cohesion funds as well as Member State own contributions.

For the receipt of the relevant amounts needed for the provisioning of the EU guarantee implemented under the blending operations and also for the ones related to the InvestEU Member State compartments, separate compartments were added under the InvestEU programme in the Common Provisioning Fund (CPF) referred to in Article 212 of the Financial Regulation.

The InvestEU programme is the successor of the Investment Plan for Europe. It consolidates nearly 30 financial instruments, budgetary guarantees and advisory initiatives deployed under the 2014-2020 multiannual financial framework in various policy areas, in particular in infrastructure, research and innovation, SMEs and social policy.

Programme website:

Impact assessment:

- The impact assessment accompanying the proposal for a regulation of the European Parliament and of the Council establishing the InvestEU can be consulted through this link.

Relevant regulation:

Evaluations:

Budget

Budget programming (million EUR):

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Total | |

|---|---|---|---|---|---|---|---|---|

| Financial programming | 693.0 | 1 430.2 | 356.5 | 363.6 | 214.2 | 215.7 | 218.8 | 3 492.0 |

| NextGenerationEU | 1 745.1 | 1 855.5 | 2 471.4 | 0.5 | 0.5 | 0.5 | 0.5 | 6 074.1 |

| Decommitments made available again (*) | N/A | |||||||

| Contributions from other countries and entities | 0.8 | 35.9 | p.m. | p.m. | p.m. | p.m. | p.m. | 36.7 |

| Total | 2 438.9 | 3 321.7 | 2 829.9 | 363.6 | 214.2 | 215.7 | 218.8 | 9 602.8 |

(*) Only Article 15(3) of the financial regulation.

Financial programming:

+ EUR 344.7 million (+ 11%)

compared to the legal basis*

* Top-ups pursuant to Article 5 of the multiannual financial framework regulation are excluded from financial programming in this comparison.

- Compared to the reference amount from the legal basis (EUR 3 067.71 million), the InvestEU appropriations include the amounts for 2022 stemming from the Cohesion and other additional Member State contributions to InvestEU Fund under Member State compartments and to the InvestEU Advisory Hub, the EFTA contributions as well as the assigned revenues (reflows) from the predecessor legacy instruments for 2021-2022.

- The frontloading of the financial programming of the InvestEU programme is mainly related to the strict deadlines applicable to the Next Generation EU funds (NGEU), under which implementing partners need to approve financing and investment operations corresponding to 60% of the NGEU budget by the end of 2022 and to 100% of the NGEU budget by the end of 2023.

- In addition, InvestEU contributed about EUR 372 million for the European Investment Fund (EIF) capital increase, in 2021, as planned under the InvestEU regulation. Furthermore, the Commission has already signed guarantee agreements with seven implementing partners as of end-2022 for a total guarantee amount of more than EUR 21 billion.

- Also, overall considering the narrow ceilings over the whole multiannual financial framework period, it was necessary to start building up the provisioning in the first 3 years to spread this over the whole period while respecting the annual ceilings of the multiannual financial framework.

- An amount of EUR 35.9 million were transferred to the InvestEU in 2022 including: (i) EUR 30 million under the InvestEU Guarantee – Greece compartment of the CPF, (ii) EUR 5.75 million under InvestEU Advisory Hub as external assigned revenues from Romania and Greece for the Member State compartment, and (iii) EUR 172 900 in commitment appropriations from the EFTA countries (Norway and Iceland) for the Portal and ancillary measures and the support expenditure budget.

Budget performance – implementation

Multiannual cumulative implementation rate at the end of 2022 (million EUR):

| Implementation | 2021-2027 Budget | Implementation rate | |

|---|---|---|---|

| Commitments | 5 729.3 | 9 449.2 | 60.6% |

| Payments | 1 782.6 | 18.9% |

Annual voted budget implementation (million EUR)(1):

| Commitments | Payments | |||

|---|---|---|---|---|

| Voted budget implementation | Initial voted budget | Voted budget implementation | Initial voted budget | |

| 2021 | 656.7 | 653.6 | 114.1 | 107.0 |

| 2022 | 1 353.0 | 1 196.6 | 209.4 | 72.8 |

(1) Voted appropriations (C1) only.

- The regulation establishing the InvestEU programme was adopted on 24 March 2021.

- Under the InvestEU Fund, the EU provides funding support through an EU budgetary guarantee of EUR 26.2 billion covering potential losses to the implementation partners.

- The budgetary guarantee is underpinned by an EU budget of EUR 10.46 billion, applying a guarantee provisioning rate of 40%.

- The guarantee agreement with the EIB and the EIF (representing a 75% share of the EU budget guarantee, i.e. EUR 19.6 billion) was signed in March 2022. Several guarantee agreements with other implementing partners were signed in the fourth quarter of 2022 (under which EUR 1.4 billion was committed): CDP Equity (from Italy); Council of Europe Development Bank (CEB); Nordic Investment Bank; European Bank for Reconstruction and Development Bank (EBRD) and Caisse des Dépôts et Consignations (CDC, from France).

- In 2022 the EUR 2.99 billion commitments included the provisioning of the Common Provisioning Fund under the EU compartment, from which future calls on the EU guarantee are to be paid. This amount includes EUR 1.16 billion from the EU general budget, EUR 1.77 billion from Next Generation EU and EUR 67.3 million internal assigned revenue from predecessor financial instruments.

- In 2022, EUR 258.7 million commitments were carried out under the blending operations that combine InvestEU support with support provided under other EU programmes (including Horizon Europe, Digital Europe, European Space Programme, European Maritime Fisheries and Aquaculture Fund, and Creative Europe Media Programme), allocated to the EIB and the EIF for top-up operations. In addition, EUR 50 million were allocated to the EIB for non-repayable transactions under the ‘green premium agreement’.

- Negotiations with various Member States concerning contributions to the Member State compartment of InvestEU were also successfully concluded in 2022. Five contribution agreements were signed with Romania, Bulgaria, Greece, Czechia and Finland. For the receipt of the relevant amounts needed for the provisioning of the EU guarantee implemented under the InvestEU Member State compartment, in 2022 common provisioning fund’ compartments for Romania, Greece, Finland and Czechia were also set up.

- Under the InvestEU Guarantee (Member State compartments of the ‘common provisioning fund’), EUR 112.5 million was transferred as external assigned revenue from two Member States (Romania and Greece), according to the schedules laid down in the signed contribution agreements. Also, as set out in the adopted partnership agreements and signed contribution agreements, the following appropriations were transferred in 2022 as contributions to the InvestEU Fund: EUR 131.6 million from European Regional Development Fund for three Member States (Bulgaria, Czechia and Finland) and EUR 25 million from Cohesion Fund for one Member State (Bulgaria).

- In 2022 the following commitments (including resources from Next Generation EU) were made: EUR 121.9 million for the InvestEU Advisory Hub, the InvestEU Portal and accompanying measures, and EUR 1.6 million for support expenditure. In addition, under the advisory agreement with the EIB, funds from several EU programmes were committed for a total envelope of EUR 42.9 million.

Contribution to horizontal priorities

Green budgeting

Contribution to green budgeting priorities (million EUR):

| Implementation | Estimates | Total contribution | % of the 2021–2027 budget | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |||

| Climate mainstreaming | 727.1 | 964.7 | 867.3 | 116.8 | 115.8 | 119.9 | 195.0 | 3 106.6 | 33% |

| Biodiversity mainstreaming (*) | N/A | 0 | 0% | ||||||

| Clean air (*) |

N/A |

83.0 | 83.0 | 1% | |||||

(*) The InvestEU contribution to clean air and biodiversity is estimated by dividing the financing amounts supporting clean air and biodiversity by the InvestEU leverage and taking into account the InvestEU provisioning rate.

- InvestEU places significant emphasis on investments that have a positive impact on the climate and the environment. The programme aims to allocate 30% of its overall financial envelope to climate objectives, while 60% of investments from the sustainable infrastructure window will support the EU objectives on climate and the environment. These targets provide strong incentives for financial institutions to develop financial products in line with the climate ambition of the programme.

- Overall, InvestEU is expected to help mobilise more than EUR 110 billion to meet EU climate goals. For example, at present, the EIB is already deploying a dedicated ‘green transition product’. The Nordic Investment Bank will provide loan financing to several renewable energy projects (notably wind power) in the Nordic and Baltic countries.

- To guide the implementation of the InvestEU financial products, the Commission has published sustainability proofing guidance(1) and climate- and environment-tracking guidance(2). Investments above EUR 10 million will be subject to sustainability proofing to identify, assess and mitigate climate, environmental or social risks. All InvestEU-supported investment will be tracked in terms of environmental and climate impact against the methodology issued by the Commission. Both guidance documents integrate, where possible, the EU taxonomy framework. InvestEU implementing partners have a choice to track the achievement of the climate and environmental targets under the sustainable infrastructure window using the EU-taxonomy-aligned criteria or the InvestEU climate and environmental markers. As of 31 December 2022, 41% of the aggregate InvestEU signed financing was tracked using EU-taxonomy-aligned criteria for the purpose of the determination of the climate and environmental objectives(3).

- For the purpose of clean air tracking, InvestEU assigns a 40% coefficient to the amounts reported on climate mitigation and pollution interventions, which amounts to EUR 1 066.7 million of signed InvestEU financing supporting these specific objectives.

- In addition to these ambitious climate targets, the InvestEU Fund set up a dedicated scheme to generate additional investment for the benefit of just transition territories – those territories that will be the most affected by the socioeconomic consequences of the green transition – in complement to the Juts Transition Fund and the public sector loan facility.

(1) EUR-Lex - 52021XC0713(02) - EN - EUR-Lex (europa.eu).

(2) InvestEU C&E T C_2021_3316_Main & Annexes_EN.pdf (europa.eu).

(3) InvestEU implementation is currently in a ramp-up phase, and the InvestEU climate and environmental targets apply at the end of the signature period. Any results are therefore preliminary indications of the progress made so far.

Gender

Contribution to gender equality (million EUR) (*):

| Gender score | 2021 | 2022 | Total |

|---|---|---|---|

| 0* | 656.7 | 1 353.0 | 2 009.7 |

(*) Based on the applied gender contribution methodology, the following scores are attributed at the most granular level of intervention possible:

- 2: interventions the principal objective of which is to improve gender equality;

- 1: interventions that have gender equality as an important and deliberate objective but not as the main reason for the intervention;

- 0: non-targeted interventions (interventions that are expected to have no significant bearing on gender equality);

- 0*: score to be assigned to interventions with a likely but not yet clear positive impact on gender equality.

- In 2022, the InvestEU programme as a whole obtained a score of 0*.

- Specific parts of the programme could have received a higher score based on their contribution to gender equality, however the EU budget allocated to these initiatives is not available. These initiatives include the following.

- The gender smart advisory initiative, which aims to provide tailored advice and capacity building to improve access to financing for female-founded and female-led companies. Its key objectives include increasing female representation in the investment community (notably by identifying barriers, strengthening women’s capacity, challenging unconscious biases, etc.), and increasing awareness of the funding gap and of missed opportunities. This will be achieved through the organisation of workshops or networking events and through collaboration with existing initiatives of the Commission, the EIB Group or the wider entrepreneurship and investment community.

- EIF equity financing, where gender smart financing is one of the horizontal topics implemented across the different thematic policy areas supported by the EIF equity products:

- the infrastructure and climate funds product of the sustainable infrastructure window / social investment and skills window;

- the intermediated equity product of the SMEs window / research, innovation and digitalisation window;

- the social impact equity product of the social investment and skills window.

- The Commission and the EIF defined gender criteria with respect to equity intermediaries, focusing on leadership aspects captured at different levels. If an intermediary complies with these criteria, InvestEU can finance up to 50% of the total commitments of the fund (as opposed to 25%).

- In addition, the indicative goal of the SMEs window / research, innovation and digitalisation window intermediated equity product (under which the EIF is expected to build a portfolio of investments of around EUR 5.5 billion) is for 25% of all its intermediaries to follow InvestEU’s leadership gender criteria, including: (i) a management team composed of at least one third of female partners, (ii) 40% female representation in the senior investment team, and (iii) at least 40% female representation in the investment committee.

Digital

Contribution to digital transition (million EUR):

| 2021 | 2022 | Total | % of the total 2021-2027 implementation | |

|---|---|---|---|---|

| Digital contribution | 0.0 | 37.6 (*) | 37.6 | 1% |

(*) The digital contribution of InvestEU is estimated by dividing the mobilised amount of investment supporting digitalisation by the overall InvestEU multiplier (i.e. ratio between expected investment mobilised and the total amount of the EU guarantee under InvestEU) and by multiplying the result by the average InvestEU provisioning rate of 40%.

- As of the end of 2022, InvestEU had mobilised EUR 1 334.5 million worth of operations supporting digitalisation.

- The EUR 3.64 billion allocated to the ‘Innovation and digitalisation guarantee’ financial product of the SMEs window will support innovation- and digitalisation-driven SMEs and small mid-caps. The EU guarantee will support, among other things, innovative business models, supply chain management, the acquisition of digital skills and support to service providers that enable and support companies in the digitalisation of value chains, as long as these service providers focus predominantly on the provision and adoption of digital products and services.

- Moreover, the joint SMEs window / research, innovation and digitalisation window equity product to be implemented by the EIF includes a sub-product that supports investments fostering the development of digital, cultural and creative industry solutions.

Budget performance – outcomes

| Baseline | Progress (*) | Target | Results | Assessment | |

|---|---|---|---|---|---|

| Investment mobilised | 0 | 19% | EUR 372 billion in 2027 | EUR 70.0 billion compared to a target of EUR 372 billion | On track |

| Multiplier effect achieved | 0 | >100% | 14 in 2027 | 15.1 | On track |

| Investment supporting climate objectives | 0% | >100% | 30% in 2027 | 51% | No data |

| Number of households and public and commercial premises with an improved energy consumption classification | N/A | N/A | N/A | 0.8 million | N/A |

| Additional households, enterprises or public buildings with broadband access of at least 100 megabits per second upgradeable to gigabit speed, or the number of Wi-Fi hotspots created | 0 | N/A | N/A | 1.4 million | N/A |

| Number of SMEs supported | 0 | N/A | N/A | No results | N/A |

| Number of engagements of the InvestEU advisory hub | 0 | N/A | N/A | 170 | N/A |

| Number of projects published on the InvestEU portal | 0 | 43% | 1 000 in 2027 | 434 out of 1 000 | On track |

(*) % of target achieved by the end of 2022.

Link to file with complete set of EU core performance indicators

- The performance of the InvestEU programme in 2022 must be measured against the fact that the InvestEU regulation was adopted with some delay in March 2021 and therefore guarantee agreements with implementing partners under the InvestEU Fund were only signed in 2022, some of which in the last quarter of 2022. Therefore, financing for investments supported by the EU guarantee has commenced, but the impact of supported investments and their concrete contribution to InvestEU objectives, as captured by the key performance indicators, will only be visible at a later stage.

- Implementing partners other than the EIB Group have been selected through a public call for expression of interest followed by negotiations of individual guarantee agreements. Opening up the InvestEU programme to other implementing partners than the EIB Group widens the geographical coverage of the InvestEU programme, expands the pipeline of projects seeking financing and diversifies the risk at both the portfolio and the programme levels.

- In 2022, the InvestEU Investment Committee met nine times and approved - under the EU compartment - the EU guarantee for 66 investment proposals (including framework operations) by the EIB and the EIF.

- As of the end of 2022, the InvestEU programme has enabled the EIB Group to approve EUR 17.4 billion investment operations (incl. framework operations), of which EUR 6.3 billion have already been signed. Financing provided by the EIB Group included investments in key policy areas of the InvestEU programme, notably under the sustainable infrastructure window, which supports financing for renewable energy investments. Those investments financed with InvestEU support directly contribute to the EU's policy objectives in the area of low-carbon energy, energy security and accelerating the green transition, thus helping to reach the policy goals stipulated in the REPowerEU plan.

- In addition to the climate-related results of the InvestEU programme, the implementing partners will also report on the estimated reduction of greenhouse gas emissions and energy savings. At the end of 2022, implementing partners estimated that the operations funded with the support of InvestEU will avoid 3.8 million tonnes of CO2 emissions, while generating an estimated 200.6 million Kw/hour of energy savings(1).

- As part of the planned roll-out of InvestEU, a number of financial products established under InvestEU would allow specific support for investments in the digital transition. At the end of 2022, an estimated EUR 1.33 billion of investment had been mobilised to support digitalisation. Projects include network expansion to provide fibre connectivity, investments into funds targeting the digital economy or financing schemes to support medium-sized enterprises and small mid-caps to help with their digital and environmental changeover.

- Measures have been taken to accelerate the financing of investments by implementing partners. These include the ‘warehousing’ of eligible financing and investment operations signed by the EIB Group and other implementing partners before the signature of the guarantee agreement, along with the use of framework operations for projects that have similar characteristics.

- The Commission supports the implementation of InvestEU through a number of communication activities, in particular (i) press releases, memos and replies to journalists; (ii) social media posts and the dedicated InvestEU website (InvestEU.europa.eu), which is continuously updated and developed further; (iii) InvestEU ‘roadshow’ events organised virtually and/or physically in each Member State, in collaboration with the EIB Group. 23 of these roadshow events took place in 2022, others will follow in 2023 and these will also progressively cover the new implementing partners.

- Concerning the InvestEU Advisory Hub, the advisory agreement with the EIB was signed in March 2022. Advisory agreements with Cassa Depositi e Prestiti (CDP, Italy), Bpifrance and CDC were signed between July and November 2022. Additional agreements with CEB and EBRD were signed early 2023. In 2022, the InvestEU Advisory Hub dealt with more than 385 requests coming directly from the central entry point for advisory requests or sourced by the advisory partners themselves. 170 of them have already been turned into ongoing or completed advisory assignments.

- The InvestEU Portal website was launched on 21 April 2021. In 2022, 535 new projects were received, out of which 434 projects were published. By the end of 2022, the InvestEU portal had provided access to 1 503 investment opportunities and more than 100 projects had received financing after being published on the portal.

- The InvestEU Portal co-organised two events with the European Business Angels Network. In addition, four virtual e-pitching events were held in cooperation with EuroQuity (France) on subjects including climate change, digital solutions, female entrepreneurship and space. Communication efforts and promotional activities are ongoing to improve the visibility of the InvestEU Portal, such as the participation and co-organisation of matchmaking events and other campaigns.

(1) Implementing partners will report on the actual realised results over time, when the related projects are completed, and when the financing is repaid.

Sustainable development goals

Contribution to the sustainable development goals

| SDGs the programme contributes to | Example |

|---|---|

| SDG1 End poverty in all its forms everywhere |

The InvestEU programme supports the economic progress through micro-entrepreneurship that contribute to alleviating the poverty. Moreover, 640 social or affordable housing units were built or renovated through InvestEU support since the start of the implementation of the programme in 2022. |

| SDG3 Ensure healthy lives and promote well-being for all at all ages |

InvestEU aims to contribute to better healthcare through investments in rehabilitation and expansion of health infrastructure and through financial support dedicated to medical research. |

| SDG4 Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all |

The InvestEU support for inclusive and equitable education and lifelong learning opportunities is channelled via social investments for educational purposes including education supported infrastructure. As of end-2022, 4 026 individuals have benefitted from educational programmes financed under InvestEU. |

| SDG5 Achieve gender equality and empower all women and girls |

InvestEU aims to provide tailored advisory support and capacity building to improve access to finance for female-founded and female-led companies. |

| SDG6 Ensure availability and sustainable management of water and sanitation for all |

The InvestEU operations contribute to the sustainable management of water resources by helping projects in the fields of water supply and wastewater treatment. As of 31 December 2022, implementing partners signed around EUR 40 million of operations supporting water resources. |

| SDG7 Ensure access to affordable, reliable, sustainable and modern energy for all |

Through the energy efficiency measures of the InvestEU supported projects, the programme has contributed to the production of over 4 716 MW of electricity from renewable energy sources. |

| SDG8 Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all |

The InvestEU projects can support meaningful advancements towards promoting sustained, inclusive and sustainable economic growth and full and productive employment and decent work for all. |

| SDG9 Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation |

Several implementing partners (for instance the EIB Group, EBRD, NIB and CEB) under the InvestEU Fund will finance innovative projects and companies as well as sustainable infrastructure investments, thus building resilient infrastructure, promoting sustainable industrialization and fostering innovation. |

| SDG10 Reduce inequalities within and among countries |

The InvestEU Advisory Hub is providing advisory support for investment project especially in countries where the financing via the capital market is the less developed. |

| SDG11 Make cities and human settlements inclusive, safe, resilient and sustainable |

The dedicated investments in economic and social infrastructure projects under InvestEU support advancement towards promoting resilient and inclusive infrastructure, and further efforts to support service-rich integrated infrastructure projects would contribute to inclusive and sustainable cities. |

| SDG12 Ensure sustainable consumption and production patterns |

The InvestEU support to inclusive business practices and SME growth and development could also contribute to promoting sustainable production and consumption practices. |

| SDG13 Take urgent action to combat climate change and its impacts |

Several implementing partners (for instance EIB Group, EBRD, NIB and CDC) will finance clean energy investments with low or zero emissions, thus combating climate change and its impacts. |

| SDG14 Conserve and sustainably use the oceans, seas and marine resources for sustainable development |

InvestEU is providing support to activities related to the sustainable use of marine resources, aquaculture and other elements of the wider bioeconomy. |

| SDG15 Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss |

InvestEU will contribute to sustainable forest management in line with the biodiversity-related priority areas which are to be supported under various financial products deployed under the InvestEU programme. |