(*) Key achievements in the table state which period they relate to. The last achievement takes also into account the implementation of the predecessor programme under the 2014-2020 multiannual financial framework.

Budget for 2021-2027

[notranslate]MFAWeb:budg_01:pie[/notranslate]

Rationale and design of the programme

Macrofinancial assistance (MFA) is a form of EU financial aid for partner countries experiencing a balance-of-payments crisis, helping to restore their external stability and to bring their economies back to a sustainable path. By relieving the partner country of some financial stress, the MFA operation increases its fiscal space, improves its debt sustainability and allows it to focus on driving necessary reforms.

The economic stability and prosperity of its neighbourhood are of key geostrategic importance for the EU. All EU Member States have a significant interest in supporting neighbouring countries experiencing a balance-of-payments crisis or an unprecedented economic shock (such as the COVID-19 pandemic), to minimise adverse macroeconomic and social spill-overs. EU-level action is thereby justified, as the benefits of prosperity, stability and security in the EU’s neighbourhood flow to all Member States.

Russia’s unprovoked and unjustified military aggression against Ukraine, which started in February 2022, has inflicted massive human suffering and disrupted Ukraine’s economic activity. Confronted with the Russian aggression, the European Union and its Member States have shown unwavering solidarity, and immediately mobilised support to the Ukrainian government to maintain its functions. In 2023, a structural approach was found for the EU’s support to Ukraine, alongside the international community, through the creation of the macrofinancial assistance plus (MFA+) instrument, which allowed the disbursement of EUR 18 billion of highly concessional loans in a constant and predictable manner over the entire year. This followed after three MFA operations to Ukraine in 2022 that had been established on an ad hoc basis in the face of the crisis inflicted by Russia’s aggression, which allowed for a disbursement of EUR 7.2 billion. For 2024 and beyond, the EU is setting up a new instrument, the Ukraine Facility. This multi-year instrument will provide a predictable flow of highly concessional loans and non-repayable support of up to EUR 50 billion until 2027 to help Ukraine resist the aggression and rebuild a modern, prosperous country.

MFA is an EU financial instrument extended to partner countries in the enlargement and European neighbourhood policy regions that are experiencing a balance-of-payments crisis. Its primary objective is to help countries overcome acute economic crises and restore their economy to a sustainable growth path, which is to be achieved through economic adjustments and structural reforms that are included in the policy conditionality of the instrument. MFA is usually provided in conjunction with International Monetary Fund financing.

MFA is part of the EU’s toolkit for macroeconomic stabilisation, which also includes the balance-of-payments assistance mechanism for Member States outside the euro area and the rescue mechanisms for the euro area created in response to the global financial crisis.

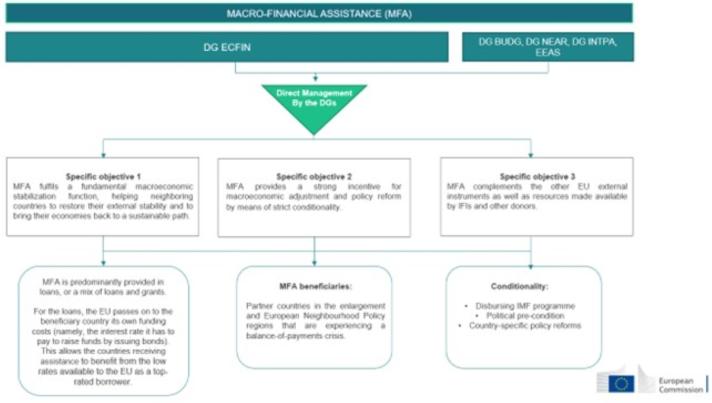

MFA has the following specific objectives.

- It fulfils a fundamental macroeconomic stabilisation function by addressing exceptional external financing needs faced by neighbouring countries and restoring their economy to a sustainable path.

- It provides a strong incentive for macroeconomic adjustment and policy reform by means of strict conditionality, and supports the EU’s accession, pre-accession and association agendas in the beneficiary countries.

- It complements the EU’s other external instruments, along with resources made available by international financial institutions and other donors, by helping to ensure that beneficiary countries put in place appropriate macroeconomic frameworks and sound economic policies – which are preconditions for the success of other projects by the EU and the donor community aiming at sustainable socioeconomic development.

MFA provides financial support to partner countries facing a balance-of-payments crisis. For standard operations, the amount of MFA provided is calculated on the basis of the residual financing needs under an International Monetary Fund programme. MFA is predominantly provided in loans, or a mix of loans and grants (the precise mix in any specific assistance depends on criteria such as the receiving country’s level of development and its debt sustainability/creditworthiness). For the loans, the EU passes on to the beneficiary country its own funding costs (namely the interest rate it has to pay to raise funds by issuing bonds)(1). This allows the countries receiving assistance to benefit from the low rates available to the EU as a top-rated borrower. The Commission typically disburses MFA assistance in instalments strictly tied to the beneficiary country’s progress with respect to:

- macroeconomic and financial stabilisation and economic recovery;

- implementation of the agreed policy reforms, as outlined in the memorandum of understanding;

- sound progress with the International Monetary Fund programme; and

- adherence to respect for human rights, the rule of law and effective democratic mechanisms (the political precondition).

(1) Given the pressure that Ukraine’s fiscal sustainability faces as a result of Russia’s war of aggression, it was decided to lessen the fiscal impact of the loans provided under the exceptional MFA I & II by setting up a subsidy to cover interest costs. This approach has also been taken with regard to the MFA+ instrument for providing support in 2023. In combination with long maturities and grace periods, the debt service from this loan package to Ukraine could effectively be reduced to zero for an extended period of time.

MFA is implemented under direct management by the Commission, under the lead of DG Economic and Financial Affairs and with the participation of other Commission services and the European External Action Service.

Throughout the period of the 2021-2027 multiannual financial framework, MFA will continue to be granted on the basis of case-by-case decisions adopted through the ordinary legislative procedure under Article 209, 212 or 213 of the Treaty on the Functioning of the European Union. In turn, the EU’s operations and those of the Member States complement and reinforce each other.

The MFA loans are provisioned at a rate of 9% by the new External Action Guarantee established by the regulation establishing the Neighbourhood, Development and International Cooperation Instrument – Global Europe (Regulation (EU) 2021/947)(2). The guarantee is backed by the new Common Provisioning Fund. The MFA decision-making process remains separate from the instrument.

MFA funds are not allocated to specific projects or spending categories and their final destination, unless otherwise specified, is left to the national authorities to decide.

In order to ensure that the financial and control framework deployed by the beneficiary country is sufficiently prepared to start/continue implementing the received funds, an ex ante operational assessment of the public financial management environment is carried out by the Commission with technical support from consultants. An analysis of accounting procedures and segregation of duties is carried out to ensure a reasonable level of assurance for sound financial management, along with an internal/external audit of the country’s central bank and ministry of finance. Should weaknesses be identified, they are translated into conditions, which have to be implemented before the disbursement of the assistance. Also, when needed, specific arrangements for payments (e.g. ring-fenced accounts) are put in place.

When the MFA is being disbursed, payments are subject to monitoring by staff from DG Economic and Financial Affairs to ensure that the payments/disbursements are eligible and regular, in close coordination with the EU delegations and with external stakeholders, such as the International Monetary Fund, of the implementation of the agreed conditionalities in the memorandum of understanding (the support is underpinned by a set of agreed policy conditions). The disbursement relating to MFA operations may be subject to additional independent ex post (documentary and/or on-the-spot) verifications.

MFA complements EU assistance under the EU budget’s ‘programmed’ instruments (e.g. the Instrument for Pre-Accession Assistance III (2021-2027)) and maximises its effectiveness by alleviating the risks of disruption of the regular EU cooperation framework whilst, at the same time, laying the basis for structural change and sustainable economic and social development of the beneficiary countries. MFA is also complementary to the other EU crisis response mechanisms and EIB lending. Furthermore, by complementing the resources made available by the International Financial Institutions (particularly the International Monetary Fund) and other donors, EU MFA contributes to the overall impact and effectiveness of the financial support agreed by the international donor community.

(2) Considering the war circumstances, the exceptional MFA operations in 2022 to Ukraine envisaged that a budgetary cover of 70% was warranted to insure the EU budget against future contingencies. To this end, the 9% provisioning from the EU budget was complemented by a further backing from the provision of Member States for another 61% of the outstanding loans. The loans provided under the MFA+ instrument deviate from this as they are backed up by a guarantee from the EU budget headroom, i.e. the budgetary space above the ceiling for payment up to the limit of the own resources ceiling under the multiannual financial framework.

In the 2021-2027 multiannual financial framework, MFA will maintain its legal status, with assistance being granted on the basis of case-by-case decisions adopted by ordinary legislative procedure under Article 209, 212 or 213 of the Treaty on the Functioning of the European Union. While under the 2014-2020 multiannual financial framework, the provisioning of the guarantee for MFA loans was managed under the Guarantee Fund for External Action, MFA loans are now guaranteed by the new External Action Guarantee under the regulation establishing the Neighbourhood, Development and International Cooperation Instrument – Global Europe, which is backed by the new Common Provisioning Fund.

Programme website:

Relevant regulation:

- ad hoc decisions under Articles 209, 212 and 213 of the Treaty on the Functioning of the European Union.

All final reports of completed ex post evaluations of MFA operations are published at:

Budget

Budget programming (million EUR):

[notranslate]MFAWeb:budg_02:table[/notranslate]

MFA is predominantly provided in the form of loans underpinned by provisions from the EU budget, and can also be provided in the form of grants. In the budget programming: EUR 1 255 million is dedicated to the provisioning of MFA loans, and EUR 318 million is dedicated to grants

Budget performance – implementation

Cumulative implementation rate at the end of 2023 (million EUR) (*):

[notranslate]MFAWeb:budg_03:table[/notranslate]

Voted budget implementation (million EUR) (1):

[notranslate]MFAWeb:budg_04:table[/notranslate]

MFA is predominantly provided in the form of loans, underpinned by guarantees provisioned from the EU budget. In 2023, EUR 290 million in MFA funds was disbursed in loans, while EUR 32.5 million was disbursed in grants. The budget lines for commitments related to provisioning of MFA loans in 2023 amounted to EUR 196.7 million.

- In 2023, a total of EUR 322.5 million in loans and grants were disbursed to aid Moldova in the context of the repercussions of Russia’s war of aggression against Ukraine and the energy crisis, and to support Jordan concluding successfully the third MFA operation in the country.

- In 2023, a total of EUR 18 billion in loans was disbursed to Ukraine Ukraine through the provision of unprecedented financial aid under the MFA+ instrument. DG Economic and Financial Affairs was the lead for the implementation of this instrument, which established the EU’s position as Ukraine’s most important donor in 2023 thanks to the complete disbursement of the entire envelope of EUR 18 billion in highly concessional loans.

Ukraine

- In the context of the escalating geopolitical tensions preceding Russia’s invasion of Ukraine, which found itself cut out of the financial markets; on 1 February 2022 the European Commission adopted a proposal for a Decision on providing new emergency MFA to Ukraine for up to EUR 1.2 billion in loans. The European Parliament and the Council adopted the Decision on 24 February 2022, thereby authorising the sixth MFA operation in Ukraine since 2014. While the first instalment of EUR 600 million in loans was disbursed in March 2022, the outbreak of the war impeded the capacity of the Ukrainian state to implement the structural policy measures associated with the second instalment of the assistance. The Commission decided, with the endorsement by Member States, to disburse the second instalment on 20 May given that the fulfilment of the conditionality was hampered by force majeure.

- As a part of the EU’s extraordinary support for Ukraine, namely, to finance the immediate funding needs following the unprovoked and unjustified aggression by Russia, on 1 July 2022 the Commission proposed a new EUR 1 billion MFA operation for Ukraine in the form of a highly concessional long-term loan. The adoption of the MFA decision by the European Parliament and the Council on 12 July allowed for the full disbursement of the assistance in August 2022, in two tranches.

- On 7 September 2022, the Commission proposed additional EUR 5 billion in MFA loans to Ukraine. Following the adoption of the decision by the co-legislators on 20 September 2022, the financial assistance was fully disbursed by December 2022, in three instalments. This operation was underpinned by a set of targeted policy conditions that were considered feasible under the conditions of martial law and upon which the Ukrainian authorities delivered.

- Less than 2 months following the request from the European Council on 20 and 21 October 2022 to establish a more structural solution for aiding Ukraine in 2023, the MFA+ regulation entered into force on 17 December 2022. This new instrument ensured predictable, continuous, orderly, and timely financing to enable Ukraine to cover its immediate funding needs in 2023, the rehabilitation of critical infrastructure and initial support for post-war reconstruction, with a view to supporting the country on its path towards European integration. The 20 targeted policy conditions underpinning this operation have been carefully designed in relation to both their relevance and feasibility in the current situation. They covered the four areas of macrofinancial stability, structural reforms and good governance, the rule of law and energy. In its decision on 15 December 2023, the Commission concluded that Ukraine has fulfilled or broadly fulfilled all agreed policy conditions, and as a result disbursed the full amount of EUR 18 billion in highly concessional loans.

Moldova

- In November 2021, following the gas crisis in Moldova, which heavily impacted the economy and contributed to higher financing needs, the authorities sent an official request for a new MFA. In response to this, the EU agreed on a new operation for Moldova of EUR 150 million, of which EUR 120 million was provided in loans and EUR 30 million in grants. The first instalment was successfully disbursed on 1 August 2022. The second disbursement, still of EUR 50 million in loans and grants, was paid in two parts (EUR 10 million in grants on 5 April 2023, and EUR 40 million in loans on 3 May 2023). The availability period runs until December 2024.

- The Moldovan economy has been heavily impacted by Russia’s invasion of Ukraine, which contributed to higher financing needs, further amplified by the ongoing energy crisis. Considering this, the authorities requested further international support. On 10 November 2022, the President of the European Commission announced an additional financial support package for Moldova of EUR 250 million, to be partly disbursed via the MFA. On 24 January 2023, the Commission adopted a proposal to increase the ongoing MFA operation by EUR 145 million, including EUR 100 million in loans on concessional terms and EUR 45 million in grants. The proposal was adopted by the European Parliament and Council on 14 June 2023.

- The first additional instalment took place in October 2023 (EUR 50 million in loans and EUR 22.5 million in grants), the second was expected for the first quarter of 2024, subject to new policy conditions added to the existing memorandum of understanding. In late December 2023, the governor of the National Bank of Moldova was dismissed. The procedure under which the governor was dismissed is a source of concern and a potential attack to the bank’s independence. In coordination with the IMF, the disbursement of the MFA is expected to continue while remedying actions are undertaken by the country in this regard.

Jordan

The third MFA to Jordan was adopted by the co-legislators on 15 January 2020 initially for an amount of EUR 500 million, and later topped-up by EUR 200 million as part of the COVID-19 MFA package. MFA III was implemented in three instalments. The first instalment of EUR 250 million was disbursed on 25 November 2020. The second instalment of EUR 250 million was disbursed on 20 July 2021. On 3 May 2023, the third and final instalment of EUR 200 million in MFA was disbursed to Jordan, thereby successfully concluding the operation.

- In October 2023, the Jordanian authorities submitted a request for a follow-up MFA operation referring to challenging global economic prospects, restrictive credit conditions due to monetary tightening, high energy costs, inflationary pressures and the burden of the Syrian refugee crisis.

- The call for further assistance comes in a situation of increased uncertainty and regional instability, not least due to the outbreak of the war in neighbouring Israel and Gaza. A new MFA proposal to Jordan of up to EUR 500 million in loans was adopted by the European Commission on 8 April 2024. The MFA is expected to be adopted by the Council and future European Parliament after the summer.

North Macedonia

- Against the backdrop of tighter global financial conditions, higher energy prices and higher-than-expected losses by the domestic, state-owned electricity producer, in a letter dated 18 October 2022 the government of North Macedonia renewed its request for MFA (the first request for which was received on 18 April 2022). In April, the government had already secured staff approval from the International Monetary Fund for a 24-month precautionary and liquidity line, with an amount of up to EUR 530 million, which was officially approved by the International Monetary Fund Board on 22 November 2022. On 6 February, the Commission adopted a proposal to provide MFA to North Macedonia of up to EUR 100 million.

- On 12 July 2023, the European Parliament and the Council adopted the decision. The MFA is expected to be disbursed in two instalments of EUR 50 million each, in April 2024 and in the second half of 2024, respectively. The release of each instalment will be conditional on progress being made with the implementation of a number of policy measures that are listed in a memorandum of understanding, which was adopted by the Commission in October 2023, along with a satisfactory track record in the implementation of the IMF programme.

Egypt - Egypt and the European Union have agreed a strategic and comprehensive partnership. On 17 March 2024, Commission President Ursula von der Leyen and Egyptian President Abdel Fattah El-Sisi presented the partnership in Cairo. A EUR 7.4 billion financing package underpins the partnership, consisting of up to EUR 5 billion in MFA, EUR 1.8 billion in additional investments and EUR 600 million in grants, including EUR 200 million for migration management.

- The new MFA to Egypt of up to EUR 5 billion is currently being discussed by the co-legislators. It is divided into a short-term MFA of EUR 1 billion to be disbursed in 2024 and a regular MFA of up to EUR 4 billion over the 2025-2027 period.

Contribution to horizontal priorities

Green budgeting

Contribution to green budgeting priorities (million EUR):

[notranslate]MFAWeb:budg_05:table[/notranslate]

Gender

Contribution to gender equality (million EUR) (*):

[notranslate]MFAWeb:budg_06:table[/notranslate]

Digital

Contribution to digital transition (million EUR):

[notranslate]MFAWeb:budg_07:table[/notranslate]

Budget performance – outcomes

- The evaluations carried out so far have concluded that MFA operations do contribute, albeit sometimes modestly and indirectly, to improving external sustainability and macroeconomic stability and to achieving structural reforms through conditionality in the recipient country.

- In most cases, MFA operations had a positive effect on the balance of payments of the beneficiary countries and contributed to relaxing their budgetary constraints. They also helped maintain or regain market access and led to slightly higher economic growth.

- An important attribute of the EU’s MFA compared to alternative sources of financing is its highly concessional terms, i.e. relatively low interest rates, long maturity and a long grace period. This generates fiscal space and contributes to public debt sustainability in the beneficiary countries.

- The ex post evaluations also confirm that previous MFA programmes were implemented efficiently, and were well coordinated with other EU programmes and with the programmes of other donors (notably the International Monetary Fund and the World Bank). MFA policy conditionality is separate from International Monetary Fund conditionality, but is complementary to and reinforces it.

- However, given its specificities, MFA cannot be linked directly to identifiable outputs, and its concrete achievements are therefore difficult to assess, as effects on macroeconomic variables over time cannot solely be attributed to MFA operations.

- MFA disbursements are sometimes delayed compared to initial expectations. External factors that might impact programme timelines include the beneficiary country not fulfilling the political preconditions; the International Monetary Fund programme being off track or having expired; the slow implementation of agreed reforms; and changes of government resulting in shifting policy priorities.

- The most common shortcomings noted in the evaluations are the operation’s lack of visibility and, in some cases, the lengthy legislative approval process for a crisis instrument. The experience with the COVID-19 MFA package and the emergency MFA to Ukraine shows that the current MFA set-up can allow for the flexibility necessary for swift adoption. The Commission worked with the Parliament and the Council to agree on the use of existing urgency procedures that allowed the assistance to be adopted within 1 month of the Commission’s proposal.

- The COVID-19 pandemic and Russia’s war of aggression in Ukraine have both severely challenged the already struggling economies of partners in the Eastern and Southern Neighbourhoods that benefit from MFA. Given the uncertain global outlook and the challenging situation many of our neighbouring countries face, a sustained, high level of demand for MFA support cannot be excluded.

Sustainable development goals

Contribution to the sustainable development goals

| SDG | Does the programme contribute to the goal? | Example |

|---|---|---|

| NA |